1. The most primitive type of money

nowadays is known as Commodity Money, Representative Money, and Fiat

Money. Each of these types of money

serves as a different method of payment. Commodity (goods that serve different

purposes), Representative (gold, silver), Fiat (money that is legal tender,

must be accepted from transactions, backed by Gov.). There are three main

functions of money which are known as medium of exchange, store of value, and

unit of account. The main function of money considered nowadays is medium of

exchange.

2. The Money Market Graph’s Label of

Axis’s are Vertical (i-interest rate) and Horizontal (Quantity of Money).

Demand of Money on the graph is sloping downwards because when the price is

high the quantity demand is low and vice versa. Supply of Money is on the

middle of your graph, in between the DM. The supply of money is set by the

FED.

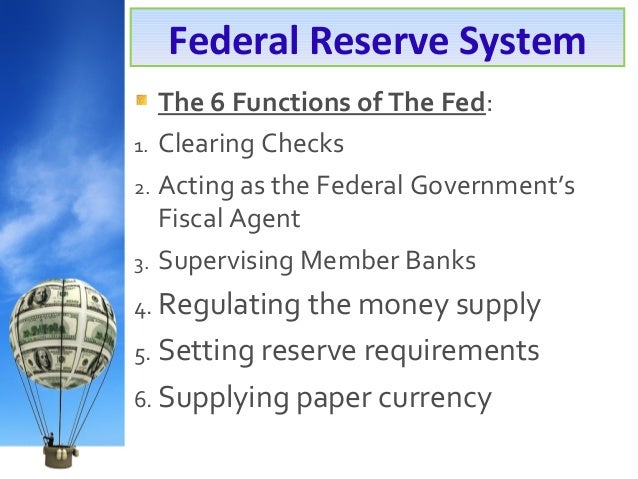

3. The FED’s two major tools of

policy are known as Expansionary and Contractionary. The FED controls the RR

either as vault cash or on reserve with a Fed branch. If the Fed wants to

increase the money supply they decrease the RR, which increases ER. The FOMC

(Federal Open Market Committee) makes decisions on Open Market transactions.

4. Loanable Funds (money that is available in the market for people to borrow) gets tied with the Money Market. Label of

Axis’s are Vertical (i-interest rate) and Horizontal (Quantity of Loanable Funds). The demand of loanable funds is downwards sloping because when the interest rate is lower people demand more money and vice versa. The supply of loanable funds comes from the amount of money people have in banks which depends on savings.

5. In the Money Creation Process banks

make money by creating loans. The money multiplier formula is one

divided by reserve requirement.

We can get from $500 loan to a $2500 increase through the process of Multiple Deposit Expansion. If any banks in a question have excess reserves your total will be reduced.

6. Most of Government's deficit is due to its owning of the United States population. This video basically summarizes the relation between the various markets such as Money market, Loanable Funds, and AD-AS graphs. Fisher Effect states that the inflation and interest rate have to be the same.