Money is any asset that can be used to purchase goods and services.

3 uses of money

- As a medium of exchange (using it to determine value- Unit of account is used to compare prices

- Store of value (where some people hide their money)

3 types of money

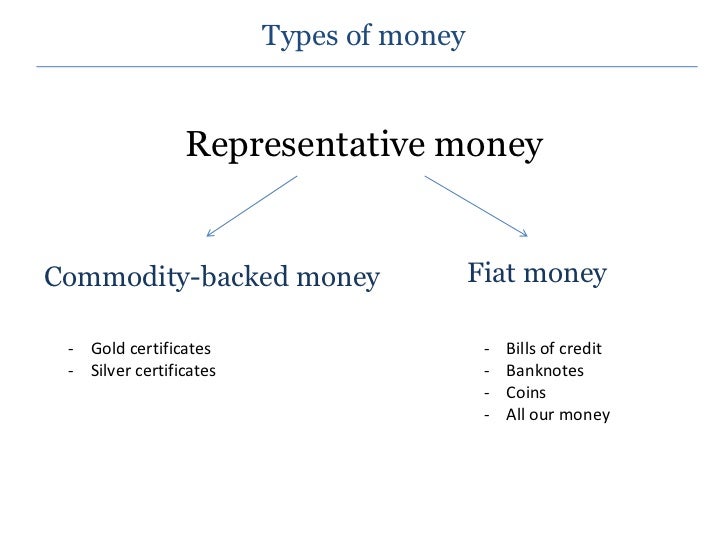

- Commodity money (has value within its self)- Representative money (represents something of value)

- Fiat money (money because Government says so)

6 characteristics of money

- Durability- Portability

- Divisible

- Uniformity

- Limited Supply

- Acceptability

Money Supply is the total value of financial assets available in the US economy.

M1 Money:

Involves Liquid Assets (easily converted to cash)- coins

- checks

- currency

- travel checks

M2 Money:

It is not as liquid as M1- savings account

- Money market account

3 purposes of financial institutions

- Store money

- Saved money

- Loan money

Two reasons why they loan money

- Credit cards- Mortgages

Four ways to save

- Savings account- Checking account

- Money market account

- Certificate of deposit

Loans: Banks operate on a fractional reserve system which means they keep a fraction of the funds and loan out the rest.

Interest rates

- Principle is amount of money borrowed

- Interest is the price paid for use of borrowed money

■ Simple Interest is paid on the principle

■ Compound interest is paid on the principle plus accumulated interest

Formula for simple interest:

I equals P times R times T over 100T equals I times 100 over P times R

P equals I times 100 over R times T

R equals I times 100 over P times T

Types of financial institutions

- Commercial bank- Savings and loans institutions

- Mutual savings bank

- Credit unions

- Finance Companies

Investment:

Redirecting resources. Consume now for the future.Financial Assests: are claims on property and income of borrower

Financial Intermediaries: institutions that channel funds from savers to borrowers. 3 purposes of financial intermediaries

- Share risks. Through diversification. Where spreading out investment to reduce risk.

- Provide information

- Liquidity (Returns) money investors above and beyond the sum of money that was initially invested

Bonds are loans that represent debt that the government or a corporation must repay to a investor. Generally low risk.

3 components of a bond

- Coupon rate is the interest rate that a bond insurer will pay to a bond holder- Maturity is the time in which payment to a bond holder is due

- Par value (principle) amount that an investor pays

- Yield is the annual rate of return on a bond if the bond were held to maturity

No comments:

Post a Comment